Featured

flat rate expenses ireland

Sign in to myAccount. FLAT RATE EXPENSES 2021 2020 2019 2018 2017.

The list of the current Flat-Rate Expenses is.

. Flat rate expenses relief is for employees. The list of the current Flat-Rate Expenses is available on the Revenue website. You can claim a flat rate payment to cover telephone rental and calls where those expenses are directly connected with the treatment.

This is why a lot of people in Ireland dont pursue claiming tax back on uniform expenses. Unlike in the UK where as a PAYE employee you can claim receipted expenses relating to your job as tax deductible expenses in Ireland you are given an allowance. Many medical and healthcare professionals in Ireland are unaware of the extent of flat rate expenses they can claim tax back on.

You can find out more on flat rate expenses here. Fill in our 60-second form and well help you claim back all that is owed to you. You can find this form in PAYE Services in the myAccount of Revenues website which is here.

Click on Review Your Tax link in PAYE Services. This relief relates to employees who must purchase uniforms. Check out our extensive list of professions who are eligible for flat rate expenses and what they can claim back.

Tax relief on medical and health expenses is given at the standard rate of 20. You might pay an employee expenses to cover any costs they incur while carrying out their duties. If Ruth claims the tax relief herself she will receive a tax rebate of 25 as he pays tax at the rate of 40.

Standard flat rate expense allowances are set by Revenue for various classes of employee for example shop workers are granted flat rate expenses of 121 per year and bar trade employees get 97 per annum. Flat rate expenses are an allowance given to PAYE worker to cover the cost of equipment that you need for work if you are in employment. The expenses are reimbursed on the basis of vouched receipts.

Flat rate expenses can be claimed for each year that you worked in certain occupations. Records to be kept. The purpose of flat rate expenses is to reduce the costs associated with work such as uniforms tools and equipment.

The amount that can be claimed varies from job-to-job. You then follow these steps. DietitiansMedical ScientistsPhlebotomistsSocial Workers andSpeech.

Flat Rate Expenses. Which is why Revenue call it a Flat Rate Expense. Nurses who supply and launder their own uniforms can claim a.

Complete and submit the form. Flat-Rate expenses list. In the Tax Credits Reliefs page select Your Job-Flat Rate Expenses and add it as a credit.

Flat-rate expense allowances Flat-rate expenses are those that cover the cost of equipment. A large number of clients are not claiming this tax relief and some are even unaware that this exists. These expenses can be reimbursed where.

Flat-rate expenses can be claimed by completing a Form 12. If youre a dentist in employment you will be entitled to a 376 Flat Rate Expense per year from 2016-2020 this is because the Flat Rate Expenses have remained the same since 2015. They are set at predetermined levels for different professions and can be quite high so for instance miners have flat rate expenses of 1312 and.

Tax relief is available at 20 for a host of medical and dental expenses in Ireland. 00621 List of Flat-Rate Schedule Expenses The content of Tax and Duty Manual Part 05-02-01 - List of Flat-Rate Schedule Expenses - is no longer relevant. Total apportioned expenses for lighting heating and broadband is 190.

Revenue concluded a comprehensive review of the flat rate expense allowances in 2019. On flat rate expenses. Removal and relocation expenses.

Revenue eBrief No. In addition the following professions have been included in the Flat Rate Expense List for 2019 and 2020. This equipment may include tools uniforms and stationery.

Travel and subsistence exemptions for certain employments. If the treatment abroad is available in Ireland you cannot claim travelling expenses for this care. Flat rate expenses refer to costs incurred by an employee on items that are necessary to complete their work such as purchasing uniforms equipment or tools.

Revenue eBrief No. Employee expenses - overview. A wide range of occupations are eligible to claim tax back on flat rate expenses the most prevalent being Medical and Healthcare professionals as well as Engineers Tradespeople Teachers.

The implementation of any planned changes to the flat rate expense regime has been further deferred until 1 January 2022. Of Ireland CORU. Employee expenses overview.

Select Income Tax Return for the year you wish to claim for. Those who can claim tax back on uniform expenses may be eligible for a rebate on a host of other tax credits. In the Tax Credits Reliefs page select Flat rate expenses and add it as a tax credit.

For example the lowest Flat Rate Expense that is available is 64 this is for cabin crew and the highest Flat Rate is 695 this is for doctors. 21919 List of Flat-Rate Schedule E Expenses Tax and Duty Manual Part 05-02-01 - List of Flat-Rate Schedule E Expenses - has been updated to include 2020 figures. So for example the lowest Flat Rate Expense is 64 for cabin crew and the highest Flat Rate Expense is 695 for doctors.

The good news for nurses is that you may be able to claim back as much as 733 per year. Your employee incurred the expense wholly exclusively and necessarily in the performance of their duties. The allowance being a fixed amount based on your occupation type.

EWorking and home workers. Flat rate expense allowances. Revenue issued an eBrief to confirm that the contents of the Tax and Duty Manual Part 05-02-01 - List of Flat-Rate Schedule Expenses - is no longer relevant.

257 rows Explanation. As Ruth lives in shared accommodation with 2 other people her expenses are split 3 ways reducing her allowable expenses to 63. To claim Flat Rate Expenses for 2018 and prior years.

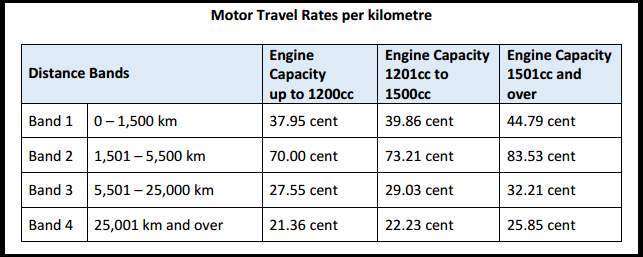

Mileage Rates Guide For Business Owners Employees Russell Co

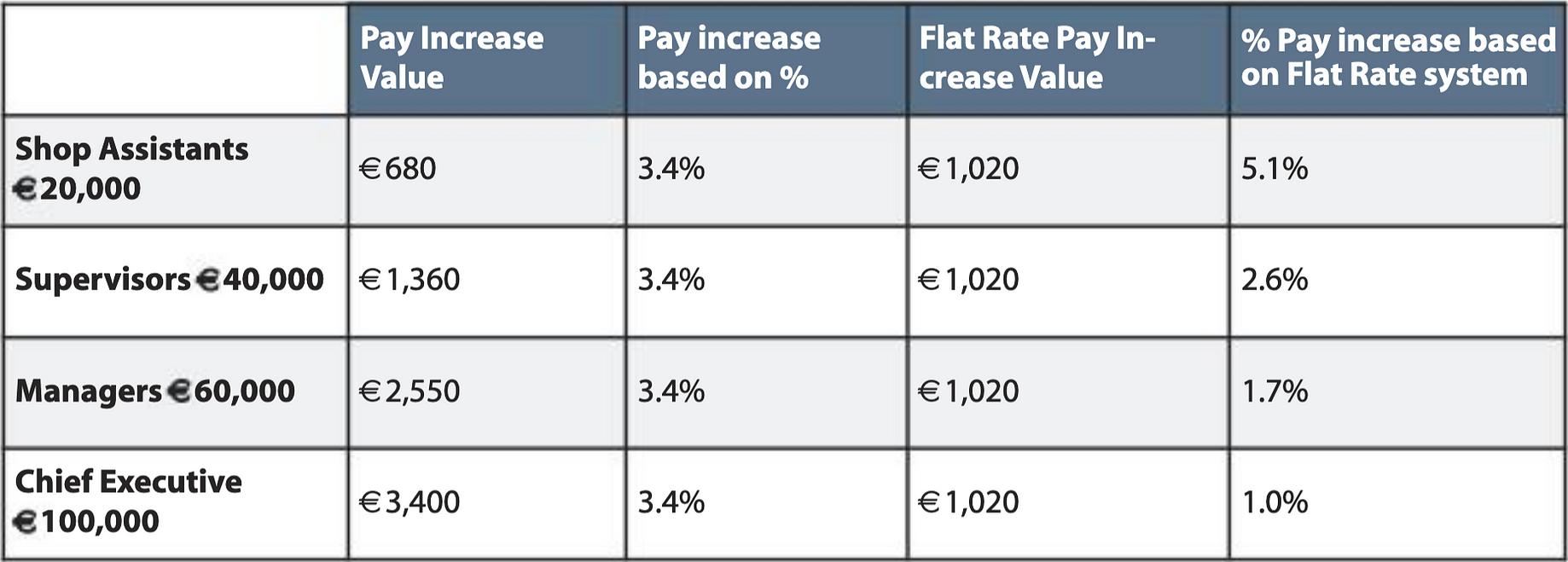

The Case For Flat Rate Pay Increases By David Gibney Medium

19 Ltd Companies Director S Expenses You Should Claim 2021

What Are Allowable Expenses When Self Employed

Tax Credits Irish National Teachers Organisation

How To Apply For A Tax Refund And What To Claim For Bonkers Ie

Flat Rate Expenses Claim Tax Back Irish Tax Rebates

Allowances And Expenses Paid To Armed Forces Personnel And Deductions From Their Income Low Incomes Tax Reform Group

Flat Rate Expenses Claim Tax Back Irish Tax Rebates

The Case For Flat Rate Pay Increases By David Gibney Medium

Irish Workers Urged To Check If They Are Entitled To Tax Rebates Now A New Year Has Arrived Joe Is The Voice Of Irish People At Home And Abroad

Tax Relief On Paye Expenses Could Land You A Minor Windfall

Flat Rate Expenses Claim Tax Back Irish Tax Rebates

Irish Paye Workers With Certain Jobs Are Owed A Tax Relief That Could Be Worth Thousands Find Out If You Qualify

Q A What Is Happening With Flat Rate Expenses And How You Could Lose Out

Tax Relief Flat Rate Employment Expenses Accountant S Notes

Why Are Some Workers Entitled To Claim Thousands In Flat Rate Expense Allowances Independent Ie

Call To Replace Working From Home Allowance With Flat Rate Relief

Flat Rate Expenses Claim Tax Back Irish Tax Rebates

Further Comments On Business Expenses Low Incomes Tax Reform Group

Tax Relief Flat Rate Employment Expenses Accountant S Notes

Work From Home Expenses Claimed By Only One In Ten Independent Ie

Tax Relief Flat Rate Employment Expenses Accountant S Notes

Civil Service Mileage Rates Documentation Thesaurus Payroll Manager Ireland 2018

Popular Posts

self adhesive contact paper bunnings

- Get link

- Other Apps

Comments

Post a Comment